STRATEGY

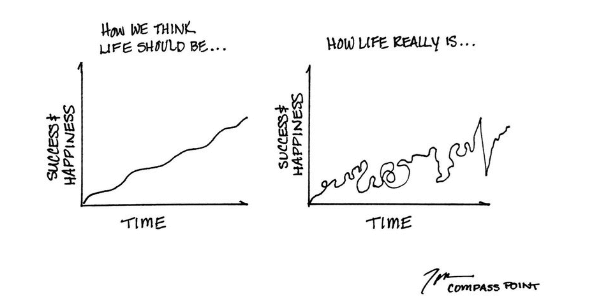

Life mimics business. Business mimics life.

There seems to be a false notion floating around – and we all buy into – that somehow we’re going to get everything in order tomorrow. Tomorrow, when we wake up, it will be the perfect day, where we will have ample time for the planning and legal work needed to minimize risk in the future. We talk a good game, but that’s not what happens. Life is messy and full of distractions.

Today will not go as planned. So what was planned for tomorrow remains undone for yet another day. I’m not referring to mundane tasks. I’m referring to the heavy lifts in business around succession, governance, and transition that most owners just do not want to tackle. There is always tomorrow they say until there’s not.

As a family business owner, it’s critical to understand there are events that will affect the transition of your business. In fact, one out of every two reading this blog will be impacted by an event beyond your control. And if you haven’t run through the checklist to prepare your business, you’re not only putting the business at risk but your family as well.

Think all this is a bit dramatic? Below are REAL situations I’ve witnessed over the years:

- If the owner/husband died under the current shareholder agreement, his wife would remain a minority shareholder, even though she worked every day by his side.

- No insurance in place for the employees to buy out the family and continue the business.

- No succession plan because the owner stubbornly remains the hub despite failing health.

Yes, we talk a lot about the 5Ds – Death, Disability, Divorce, Distress, and Disagreement – with good reason. 100% of business owners will exit their business yet only 50% will do it on their terms. The other half is scrambling.

And by the way, a 5D event doesn’t have to happen directly to you to disrupt the business. Think about the fallout if it involved a:

- Key member of the leadership team (tribal knowledge gone and no documentation exists)

- Ownership member (out-of-date shareholders agreement)

- Family member (owner can’t truly step away to grieve or care for a loved one)

Begin by adopting the mindset of, “my business is always for sale” (and actually, that’s the way it should be).

Working with the mindset that your business is always ready to be sold, means:

- You’ve got great financials

- You play in a growing market

- You have a competitive advantage in the marketplace

- You have limited customer concentration

- You have customers who repeat and refer

- Your business generates cash like a spigot vs sucking it out like a drain

- You’ve got a strong cash balance and balance sheet

- The business doesn’t rely on you as the owner

- And you have good governance in place, with an ownership council, a board of directors, a family constitution, and a family council

All these things will not only make your business successful today but attractive to potential buyers in the future, including internal successors. Ultimately, building a business that’s transferable means that it can run without you and that’s also the best way to survive one of these 5Ds.

Do the right things – the hard things – to position your business for whatever life throws your way. It will be more financially successful, more fun to operate, and better protect those you love.

Life is messy. But the future of the business doesn’t need to be. Make the commitment to tackle just one “what if” today, and check it off your list so it’s done.

Not sure where to start? Contact me and we will walk through the checklist.

You may also like…

BLOG | LEADERSHIP

The Multiplier That Makes Businesses Grow

If your leadership team isn’t strong, aligned, and equipped with the right tools, how can they bring your strategy to life? The short answer: they can’t. But the good news? You can change that with this critical ingredient.

Read More

BLOG | LEADERSHIP

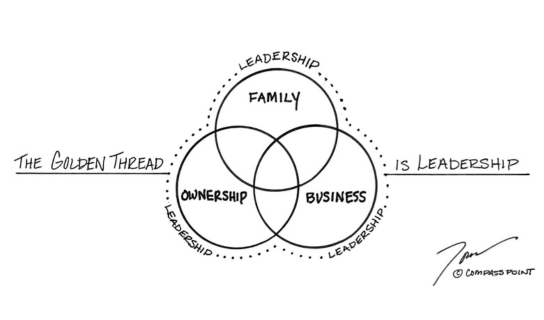

The Golden Thread that Binds Family, Business, and Ownership

The most successful family businesses don’t leave leadership development to chance. They recognize that leadership isn’t just about a single person at the top – it’s about building a system that supports leadership at every level – and through each of the 3 domains of a family business. It truly IS the golden thread that binds.

Read More

BLOG | TRANSITION / SUCCESSION

From Empires to Enterprises: Succession strategies that make or break legacies

History provides us the benefit of hindsight and powerful lessons. Take Genghis Khan and Alexander the Great, both great conquerors. Yet one implemented a structured succession plan that ensured the survival and expansion of his empire, while the other's failure to do so led to the disintegration of his vast holdings shortly after his death. A strong succession planning is the ultimate competitive advantage.

Read MoreWhere Family Businesses Come to Grow & Learn

At Compass Point, we make it easy to get insights, training, tools, and articles straight to your inbox and help family business owners and their team continue to grow, learn, and lead.