OWNER FINANCIAL GAP

It’s The Simple Math That Doesn’t Get Done

Originally posted: September 1, 2021

Updated: July 18, 2023

Family business owners are passionate about what they do. They’re working to carry on a business that family built – by their parents, grandparents, sometimes even great-grandparents and beyond. These owners are so busy providing for their employees, communities, and the next generation that they often ignore their own financial future.

Boiling it down to its true essence, business is a means to building wealth. And what are we supposed to do with that wealth? Ideally, it should fund our retirement, philanthropic desires, and future plans. In reality, unfortunately, many business owners work hard in their businesses without ever taking the time to:

- Develop a personal financial plan outlining how they will maintain their current lifestyle when they no longer own or work in the business

- Determine a process to take some of their business equity OUT of the business, rather than continually reinvesting it all in the business

- Consider how much they use their businesses as their personal piggy banks

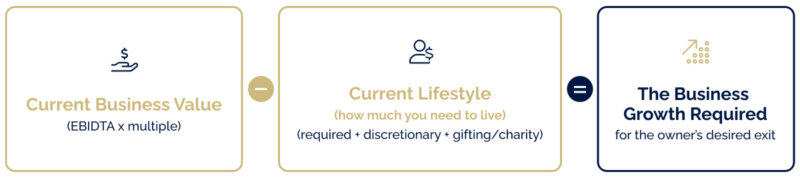

All of the items above can be managed and developed by working with a wealth manager to determine what we call your “personal financial gap.” Here’s where the simple math comes into the picture:

This simple Financial GAP Calculation will uncover 3 possible realities:

- The business value is lower than needed or is unknown

- The owner’s lifestyle is not sustainable without the business

- How big the Financial Gap between Business Value and Lifestyle truly is

Let’s break down this equation and where these numbers come from:

- Business valuation. Work with an outside business valuation specialist who will research and give you an estimated value of the business. One way to estimate business value is by using EBIDTA (Earning Before Interest, Depreciation, Taxes, and Amortization) x Multiple. The multiple needs to be based on the reality of the marketplace and the transferability of the business, not the emotional value to the owner.

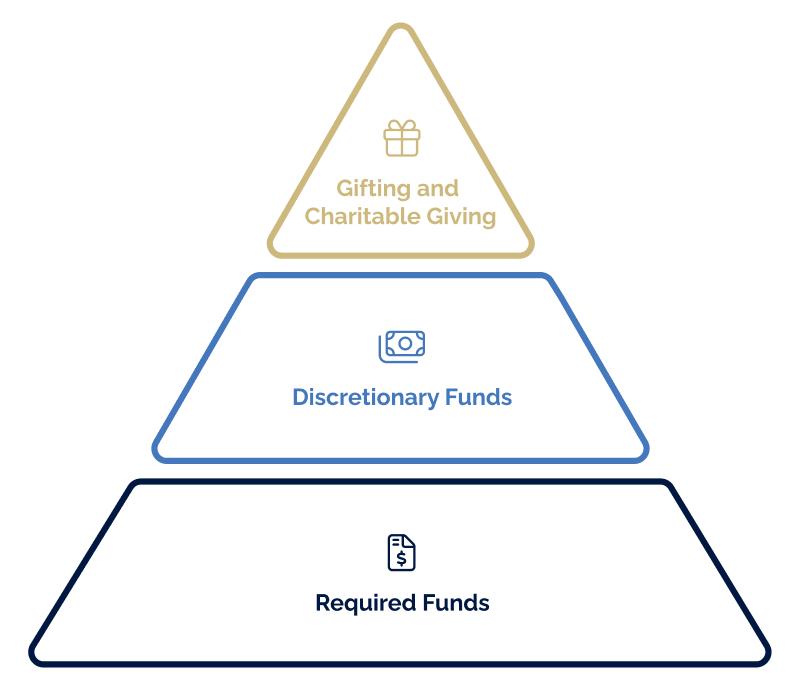

- Lifestyle Number. Envision a triangle with 3 layers: At the base are required funds, the middle layer is discretionary funds, and the last section at the top is gifting and charitable giving.

- Required funds pay for required monthly expenses, like mortgage or rent, vehicles, utilities, insurances, healthcare premiums, medical expenses, and food. If you don’t pay for them, you’re not going to have them. And remember you won’t always have the business to fund them.

- Discretionary funds pay for the “fun things” – wants and desires like vacations, hobbies, and dining out – not needs.

- Gifting and charity funds are the last part of the pyramid. Meaningful donations to charity and gifts to grandchildren or alma maters live here.

- Financial Gap Number. Once we know the two values above, we can uncover the financial gap amount. The size of this gap (what’s between the wealth locked in the business and the post-transition lifestyle the owner desires to maintain), provides the foundation for creating the plan to fuel the growth needed to fill the gap.

It’s simple math. Yet, it’s a calculation that many business owners simply do not take the appropriate time to do.

Don’t gamble with your legacy. Get a clear picture of your Financial Gap now, while you have the time and energy to change the equation.

If you’re still unsure about how to get started or have questions about Business Valuation, we’re here to help. Join us on July 27th for The Collective, a 1-hour family business coaching event and peer group. During this time, we’ll share a short lesson on Understanding and Simplifying How Business is Valued and then answer any questions you and your fellow business owners have.

Join the Collective

You may also like…

BLOG | FAMILY DYNAMICS / GOVERNANCE

The 4-Letter Word Owners Can’t Afford NOT to Talk About: EXIT

I’ve had my share of family business owners who avoid discussing this four-letter word to the point of pure denial, quickly ending the conversation when this word bubbles up. The word? E-X-I-T. It sounds so final. The brutal truth is that 100% of owners exit the business, yet only 50% – just 1 out of 2 owners – will do it on their terms...

Read More

BLOG | LEADERSHIP

Family Business Peer Groups are Gamechangers for the Next Gen

Many family-led companies hire business consultants to grow the business. Some even send their emerging leaders to personal development programs. But there is a gap – and it’s a BIG one.

Read More

BLOG | PEOPLE / TALENT

Unlocking the Golden 5% in Your Employees

The Golden 5% is the full expression of our ability, multiplied by our maximum possible effort, multiplied by our full contribution of heart. It is the performance equivalent of what we offer in a deeply loving relationship – the absolute best of ourselves. And yet, we rarely give it or reliably inspire the giving of it by others in organizations. Why?

Read MoreWhere Family Businesses Come to Grow & Learn

At Compass Point, we make it easy to get insights, training, tools, and articles straight to your inbox and help family business owners and their team continue to grow, learn, and lead.