FAMILY DYNAMICS / GOVERNANCE

The 4-Letter Word Owners Can’t Afford NOT to Talk About: EXIT

I’ve had my share of family business owners who avoid discussing this four-letter word to the point of pure denial, quickly ending the conversation when this word bubbles up. The word

E-X-I-T.

It sounds so final. The brutal truth is 100% of owners exit the businesses, yet only 50% – just 1 out of 2 owners – will do it on their terms. If you are a family business owner over 55 and you have not begun the process of planning for the day you are not at the helm, then your chances of being in the wrong half of that statistic are against you – and your family’s legacy.

Let’s change the conversation around exiting the business.

There is a different way to look at stepping out of the business you have spent decades building. Rather than avoiding it, take a proactive approach through a methodical assessment of options on a timeline designed to fit your terms.

Succession.

The word conjures up images of royalty, birthright, and heir apparent status. The lineage method may work in a monarchy, but in a family business, there are always other factors to consider. Often, it’s not the eldest son or daughter who takes over a generational business. It could be someone else within the family: brother, sister, niece, nephew, or cousin. It could also be someone outside the family or even outside the company.

Last name should never be the deciding factor. Getting the RIGHT person READY to SUCCEED should be the one and only focus.

So, from where you are sitting right now, WHO is best suited to lead the organization today and where it is going tomorrow once you exit the business? Do you have a short list? Do you have any list?

Let’s dive one layer deeper…

Planning for exiting the business and succession isn’t just for the CEO /President seat. What happens if you lose a key executive to retirement, illness, or a competitor? Do you have a succession plan for all your key leadership roles? If not, start building one today with their input.

Next up Transition.

This is where you need to think about time as a runway and ask yourself these questions:

- How much runway (aka time in years) do you need to prepare for life outside of business?

- How long does your successor (from our conversation above) need your mentorship?

- Do you have sufficient wealth to sustain your lifestyle after there is no paycheck?

- What happens to the ownership model upon your exiting the business?

- What will your purpose be when work is no longer calling your cell?

The worst decision is to ignore time and wait for a 5Ds event to determine your last day. Succession and transition are not single, solitary events. It takes at least 3 years of planning. Why 3 years? Because any successful transition needs time to unfold as people develop to fit new levels of leadership and scalable systems are built for future growth and innovation.

Your job is building a business that runs without you. It’s no longer your job to do ‘work in the company.’ That job is over. Your job now is to build out a leadership team, including the new CEO, who will lead the company successfully after you.

Keep in mind that succession and transition are two different processes.

Succession is finding and mentoring the new leader who will get the company to its desired vision. Transferring your knowledge, relationships, and leadership takes time. And if this is a two-step process, i.e. you place an interim leader at the helm to help develop and lead Next Gen, it requires even more time.

Transition is mostly about ownership and wealth protection. Getting this right and communicating it well so you don’t blow up the family takes time. Working with estate planners, financial advisors, CPAs, business attorneys, and family business consultants all takes time. Simply coordinating this circus is a full-time job (a good family business consultant helps coordinate all of this).

One final thought – leadership and ownership are two different things. It’s one thing to transfer ownership on paper. It’s another to smoothly navigate the leadership transition, in fact, I believe it is the single most important factor in generational family business success.

Here are two tools to help you start planning your succession and transition plan, even if it’s 10 years away.

- 10 Steps to Take Now to Prepare for Family Business Transition

- 6 Discussions Every Family Business Needs to Have

I want to leave you with this. Not once in my 20 years of serving family businesses have I heard an owner say, “I spent far too much time ensuring the business would succeed without me.” Said no owner EVER.

Need help with a strategy for exiting the business?

If you’re not sure where to start planning for your exit or still have questions after reviewing the tools, let’s talk. Our family business consultants are here to help.

Book a MeetingYou may also like…

BLOG | LEADERSHIP

The Multiplier That Makes Businesses Grow

If your leadership team isn’t strong, aligned, and equipped with the right tools, how can they bring your strategy to life? The short answer: they can’t. But the good news? You can change that with this critical ingredient.

Read More

BLOG | LEADERSHIP

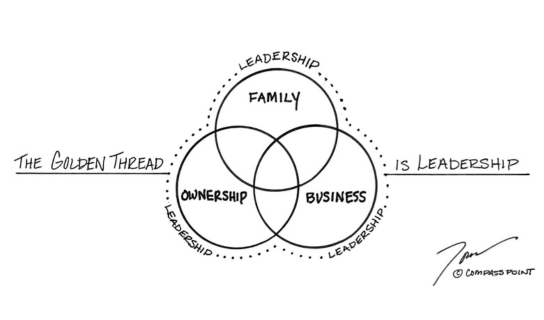

The Golden Thread that Binds Family, Business, and Ownership

The most successful family businesses don’t leave leadership development to chance. They recognize that leadership isn’t just about a single person at the top – it’s about building a system that supports leadership at every level – and through each of the 3 domains of a family business. It truly IS the golden thread that binds.

Read More

BLOG | TRANSITION / SUCCESSION

From Empires to Enterprises: Succession strategies that make or break legacies

History provides us the benefit of hindsight and powerful lessons. Take Genghis Khan and Alexander the Great, both great conquerors. Yet one implemented a structured succession plan that ensured the survival and expansion of his empire, while the other's failure to do so led to the disintegration of his vast holdings shortly after his death. A strong succession planning is the ultimate competitive advantage.

Read MoreWhere Family Businesses Come to Grow & Learn

At Compass Point, we make it easy to get insights, training, tools, and articles straight to your inbox and help family business owners and their team continue to grow, learn, and lead.